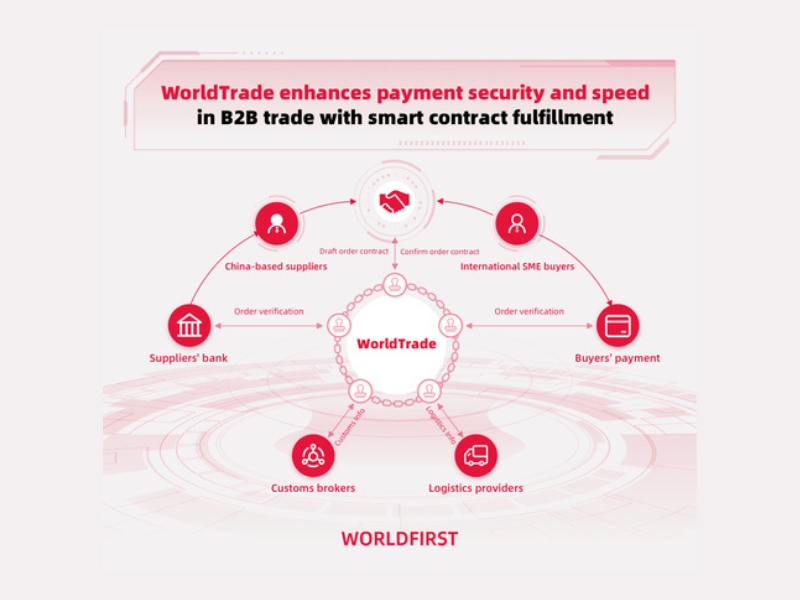

WorldFirst, one of the preferred digital payment and financial services platforms for global businesses, especially SMEs in international trade, has launched WorldTrade, a new payment solution for global sourcing to bolster the security and speed of cross-border payment for international Small and Medium-sized Enterprises (SMEs) that procure goods from suppliers based in China, while ensuring the prompt delivery of products for the SME buyers.

As a fresh addition to WorldFirst’s suite of global sourcing payment solutions, WorldTrade employs smart contract-fulfillment technologies to protect and improve SME buyers’ sourcing operations by delivering:

Enhanced protection of buyers’ fund: WorldTrade protects the funds of the SME buyers by scrutinizing sellers’ reliability and enforcing contractual commitments, which can curtail the risk of financial losses due to fraudulent transactions.

Timely delivery of goods: Using WorldTrade, once the trading parties enter into a contract, the system can initiate payment and delivery of goods based on the payment conditions and timing stipulated in the contract.

Faster payment to sellers: WorldTrade facilitates immediate payment directly into the accounts of the sellers while offering international buyers the flexibility to pay their suppliers using a credit card, a debit card, or the WorldFirst platform World Account. Current channels usually process an international B2B trade payment within a span of one hour to seven days.

Reduced Transaction costs: When both the buyer and seller use World Account, they will be able to save more on transaction fees and currency exchange costs. An SME conducting annual trade worth US$10 million through WorldFirst could realize an estimated savings of at least US$10,000 in transaction costs each year.

WorldTrade is able to facilitate smart contract-fulfillment because of WorldFirst’s extensive collaborations with banks, customs offices, and logistics providers, allowing WorldTrade to consolidate and validate crucial trade transaction information, including payments, customs clearance, and delivery.

“The launch of WorldTrade aims to build trust in B2B trade through digital means,” said Ma Qisheng, Head of Global B2B Business at WorldFirst. “WorldTrade facilitates intelligent payment processing aligned with agreed trade terms, minimizing trade barriers and streamlining global business interactions.”

Image taken from Businesswire

In addition to WorldTrade, WorldFirst also supports international buyers in sourcing from China with the Cross-border Pay solution in partnership with 1688, one of China’s largest wholesale marketplaces. The solution gives international SME buyers an option to make payments to 1688 sellers without the need to set up an onshore bank account in China, and to benefit from highly competitive foreign exchange rates.

WorldFirst is the first official cross-border payment partner of 1688. Transaction volume of the 1688 solution grew at an annual average rate of over 70% from 2019 and 2023 on the back of robust international demand.

Interested to read about other companies in the digital platforms industry? Then please read:

PayPal and Venmo Unveil Six New Innovations to Revolutionize Commerce

Singapore’s iMin Technology raises USD 5 Mln in Pre-A Series funding

Klarpay AG welcomes Markus Emödi as Chief Legal & Compliance Officer