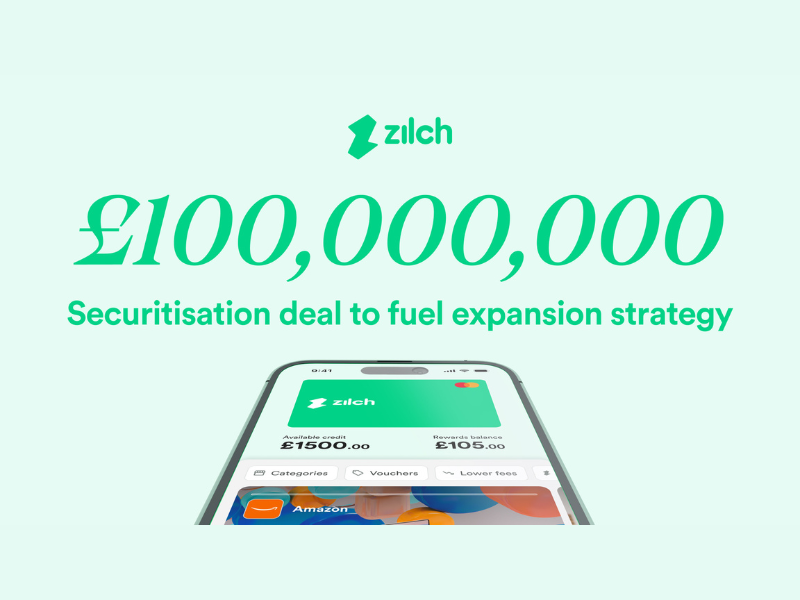

Zilch, one of the world’s ad-subsidised payments networks (ASPN), today announces a key £100 million securitised debt financing arranged by Deutsche Bank (DB).

The financing will enable Zilch to grow its business and accelerate Zilch’s ability to create and launch new products for a broader base of customers.

In just under four years, Zilch has achieved remarkable growth, amassing over 4 million customers and now processing more than 10 million monthly payments. Zilch gives customers a reward-earning debit & zero-interest instalment offering in one. The platform has already generated over £2.5 billion in commerce and saved its customers more than £450 million in fees and interest through its ad-subsidisation model, as it works to eliminate the high cost of consumer credit.

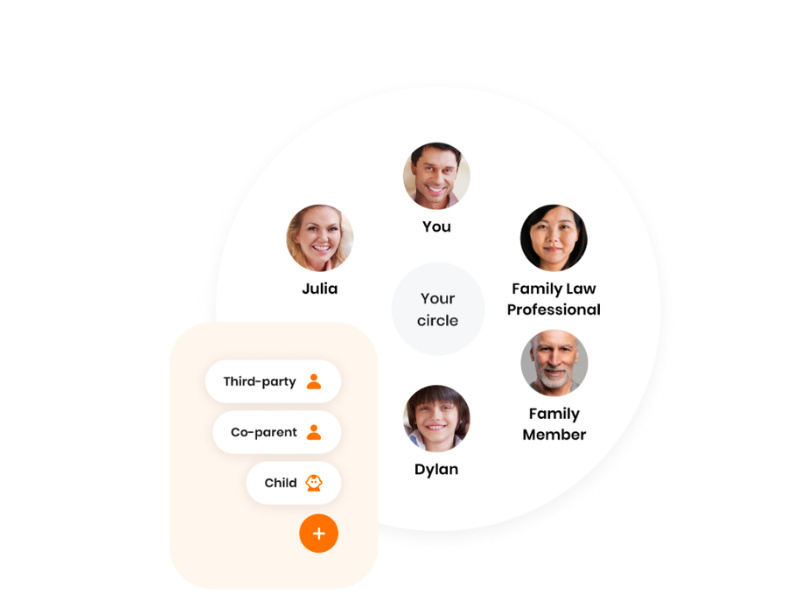

Image taken from Zilch website

Zilch CEO and Co-Founder Philip Belamant said: “We’re thrilled to announce the financing as it marks a transformative step in Zilch’s journey. With this new securitisation, we’re poised to triple sales volumes and achieve significant capital efficiencies as we continue to drive billions in commerce to our retail network and, in turn, hundreds of millions in savings and subsidies to our customer base.

“This partnership not only provides an excellent opportunity for debt investors to join in Zilch’s success, but it also enables us to accelerate the rollout of our feature roadmap which will broaden wallet and market share. We’re adding over 100,000 new customers every month, doubling revenue year over year, and this deal will allow us to build upon that momentum.”

Image taken from Zilch website

Hugh Courtney, Chief Financial Officer of Zilch, said: “We are excited to announce our entry into the securitisation market. Optimising our capital structure and pricing is key to providing our customers with more flexible ways to pay. Deutsche Bank really leant in to find a bespoke solution to match our uniquely capital-efficient model.

“The financing sets an initial benchmark for us to price our debt issuance in the future, allowing us to competitively match the pricing and terms as the business continues to develop. Finally, the securitisation represents a major milestone as we work towards an IPO in the future.”

Interested to know about other funding news? Then please read:

Highperformr Secures USD 3.5 Mln in Seed Funding to Help B2B Businesses

akirolabs raises USD 5Mln in Seed Funding

Novatron Fusion Group receives a funding of EUR 5 million

Matter raises $10 Million Series A Funding