Newmark Group, Inc, a leading commercial real estate adviser and service provider to large institutional investors, global corporations, and other owners and occupiers, recently announced that it has entered into a Delayed Draw Term Loan Credit Agreement to repay the principal and interest related to all or a portion of the Company’s $550 million 6.125% Senior Notes due November 15, 2023 (the “Senior Notes”).

“This new Credit Agreement, together with the $300 million to $350 million of cash we expect to generate from our business1 this year and Newmark’s $600 million revolving credit facility, provide sufficient capital to refinance our Senior Notes and continue to invest in growing our business”, said the Company’s Chief Financial Officer, Michael Rispoli.

On August 10, 2023, Newmark entered into the Credit Agreement with several financial institutions that committed to provide a $420 million senior unsecured Delayed Draw Term Loan, which may be increased to up to $550 million, subject to certain terms and conditions (the “Delayed Draw Term Loan”). The proceeds of the Delayed Draw Term Loan will be used to repay the principal and interest related to all or a portion of the Senior Notes. The Delayed Draw Term Loan will mature on the earlier of November 15, 2026 and three years from the initial funding date.

The initial all in rate of the Delayed Draw Term Loan is approximately 7.9%.2

For more information on the Credit Agreement, including with respect to pricing, please see Newmark’s Securities and Exchange Commission filing on Form 8-K.

BofA Securities, Inc. acted as the active lead arranger and bookrunner for the Credit Agreement, while Bank of America, N.A. will serve as the Administrative Agent. Additional institutions named as joint lead arrangers and joint bookrunners are Citizens Bank, N.A.; Fifth Third Bank, National Association; PNC Capital Markets, LLC; Regions Capital Markets; U.S. Bank National Association; and Wells Fargo Securities, LLC.

For more investment related news:

Hallador Energy receives USD 140 million credit facility from PNC Bank

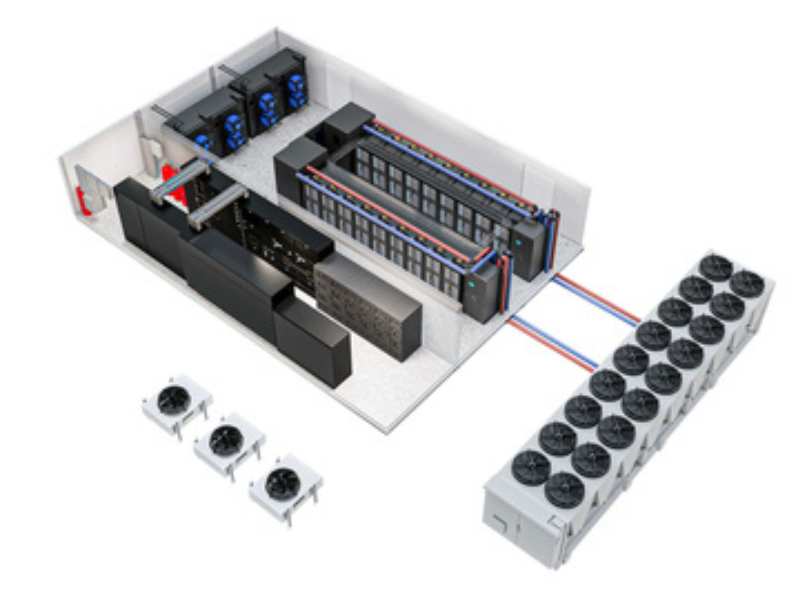

DEAC and DLC to invest in telecom infrastructure expansion

Stamus Networks receives $6M Series A funding