Bluefin recently announced Bluefin v2, the next step of its decentralized, orderbook-based exchange. Bluefin v1 supports the trading of perpetual swaps and is currently powered by Arbitrum, a layer 2 blockchain leveraging the security of Ethereum. While we will continue to operate and maintain Bluefin v1, with v2 we aim to build a decentralized platform that can match the features and trading experience of centralized exchanges, for both professional and first-time traders. This includes supporting new features such as spot trading as well as overcoming the performance limitations and high gas fees on existing Layer 2s.

Key Takeaways

- Timeline: Bluefin v2 will be released in a beta state in September followed by several features that include instant trade confirmations, sub-second finality, fully-decentralized spot markets, cross-margin, and trading without wallets. These will be rolled out over the next six months.

- Performance: ~30ms optimistic trade confirmations, ~550ms finality, 5,400+ peak TPS

- Eliminating Wallets: We’re working to emulate the Web2 trading experience while retaining the decentralization benefits of an on-chain trading protocol

- Cost of Execution: The spread on Bluefin v1 is currently <0.001% and with reduced latencies and gas fees below $0.005 on v2, users will benefit from even lower trade execution costs.

Bluefin v2

Bluefin has rewritten its codebase and built on a new underlying technology. Bluefin v2 is built on Sui, which enables horizontally scalable performance and a wallet-less trading experience that competes with the user experience of a centralized exchange. Bluefin v2 comes with:

- Optimistic trades streamed sub-second and eliminating the need for wallets.

- Spot trading using Sui’s on-chain order book further enhances Bluefin’s decentralization, transparency, and security.

- A new margining engine with cross-margining capabilities.

- An underlying layer 1 that has seen a peak throughput of over 5400 TPS on mainnet and a peak throughput ranging from 10,871 TPS to 297,000 TPS while benchmarking in a series of tests

Performance

Bluefin’s goal is to ensure that users experience sub-second trades, finalized on-chain, and reflected instantly on their UI. These are two key performance components of Bluefin v2: optimistic trade confirmations and on-chain finality.

With Sui’s parallel execution, the availability of the network is not constrained by other applications and users. As a result, the success rate of transactions submitted on-chain is extremely high. Building on this guarantee, Bluefin has redesigned the off-chain order book layer to send optimistic confirmations of trades in ~30ms back to users and ensure eventual consistency with the on-chain smart contracts in ~480ms on average based on benchmarking in a production environment.

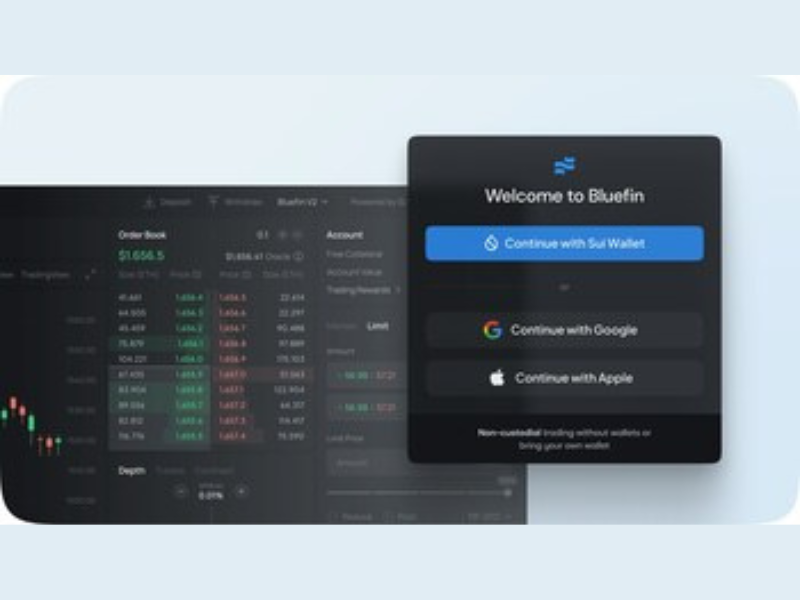

Eliminating Wallets While Remaining Non-Custodial Bluefin is working on eliminating the need for users to bring their own wallets by making on-chain interactions invisible to users. Abstracting away private key management and the need for wallets altogether, while remaining non-custodial, is a key milestone for decentralized finance. There are three phases here: i) natively-supported social login using zkLogin, ii) easy fiat on-ramp and transfers from other exchanges and blockchains, and, iii) eliminating wallets altogether.

Interested to know about other companies in the trading sector? Then please read

BingX introduces Multiple Deposit Addresses for each blockchain network

Talos partners with Figment to add staking for institutional customers