Canada Growth Fund Inc. (“CGF”) and Svante Technologies Inc. (“Svante” or the “Company”), a leading global carbon capture and removal solutions provider headquartered in Vancouver, Canada, announced yesterday a financing commitment of up to US$100 million to accelerate the development and construction of Svante’s commercial carbon capture and removal projects in Canada and the US.

CGF has a mandate to invest in Canadian clean technology businesses that are scaling technologies currently in the commercialization stage of development. Svante is a leading developer of carbon capture and removal technology, with significant potential to accelerate emissions reductions in hard-to-abate sectors worldwide. CGF’s investment enables the Company to focus on its first-of-a-kind (FOAK) deployment opportunities and will encourage the business to prioritize opportunities in its Canadian pipeline. CGF’s capital is supporting ongoing Canadian operations and will encourage Svante to accelerate the delivery of projects domestically and internationally, leveraging their Canadian IP and manufacturing capabilities.

Image taken from LinkedIn Profile

“CGF is working to accelerate the deployment of key Canadian carbon capture technologies, and to scale the manufacturing and export of promising solutions to showcase Canadian technologies internationally,” said Patrick Charbonneau, President and CEO of Canada Growth Fund Investment Management Inc. (“CGF Investment Management”). “Svante has a tremendous market opportunity, globally and here at home, and we look forward to supporting this company in its growth.”

CGF will fund its investment in two tranches: (i) an initial tranche of US$50 million will be used to accelerate and de-risk FOAK commercial projects currently underway and (ii) a potential second tranche expected to be tied to project-specific requirements to match Svante’s capital needs for the development and construction of projects alongside the Company’s co-development partners.

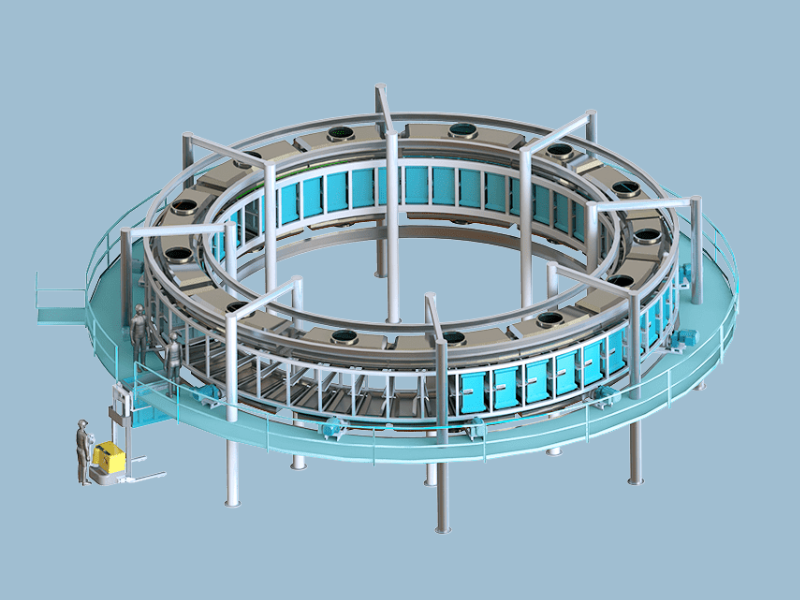

Image taken from Svante website

Claude Letourneau, Svante’s President and CEO, said: “We are delighted with this investment by CGF. It is transformational for Svante and complements the US$145 million capital investment made in our new carbon capture and removal filter manufacturing facility under construction in Vancouver. This will strengthen our Integrated Project Development Services offering to help our customers de-risk FOAK projects by providing both our in-house project development advisory expertise and financing. This new offering bridges the gap for our customers as it enables them to reach final investment decision.”

Transaction Highlights

- CGF will invest up to US$100M in Svante via convertible note(s), aimed at advancing the development of Svante’s innovative carbon capture technology.

- The investment will be made in two tranches: the first tranche of US$50M will be disbursed immediately, and the second tranche of US$50M can be drawn for the development and construction of carbon capture projects with a focus on Canadian projects, subject to approval by both organizations.

- Svante is constructing a 141,000 sq. ft. facility in Burnaby, BC, Canada, which will produce filters capable of capturing 10 million tonnes of CO2 annually and serve as the company’s global headquarters and R&D center.

- The proceeds from the first investment tranche will be utilized for commercial development and FOAK project funding.

- This investment aligns with CGF’s mandate by supporting a leading Canadian cleantech company, protecting Canadian IP and jobs, and encouraging the development of Canadian projects and innovation activities.

- The investment will accelerate the deployment of Svante’s innovative carbon capture technology, which has the potential to significantly reduce global CO2 emissions.

- This investment marks CGF’s first venture in British Columbia, supporting local jobs in the province and diversifying its investment portfolio.

- The market for carbon capture and sequestration, and carbon removals, is expanding, with supportive regulations in place in Canada, the USA, and Europe, highlighting the growing demand for emissions reduction and removal technologies.

Interested to learn about similar news? Then please read –

Zilch raises 100 Mln Pounds Financing Deal to fuel Expansion Strategy

Bionova Scientific announces USD 100 mln investment in new Plasmid DNA facility