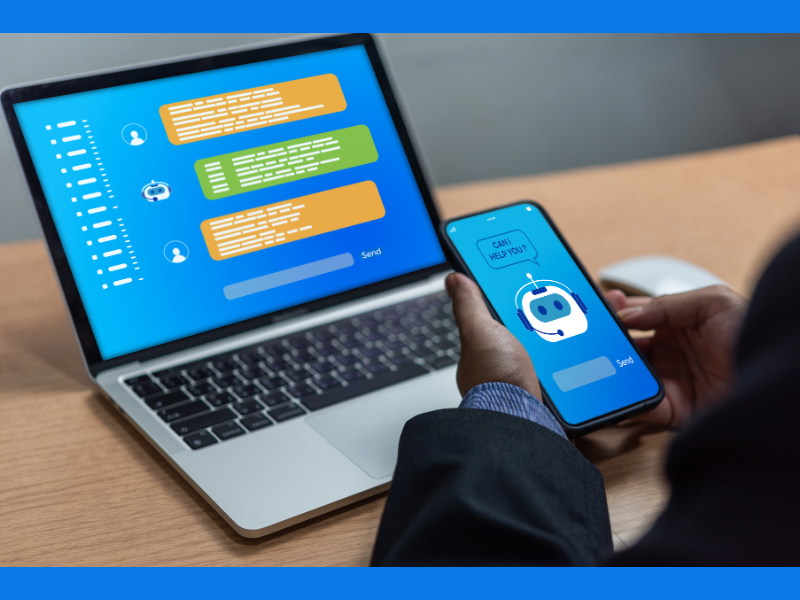

Automation has become a ‘MUST’ in every sector. There is the banking industry, that needs the highest number of automation software. This sector gets the highest number of inquiries every day. This sector is the perfect space for chatbot developers to showcase their skills. They should design banking chatbots that take less time to answer customer questions/doubts. Today, 60 to 70% of customer queries in the banking industry are solved by chatbots.

Chatbots are computer software programs that use natural language processing (NLP) to answer queries. This program uses AI/ML to design responses per customer needs.

The most common requests of customers that banks/financial institutions receive are:

- Checking balances

- Transfer of funds

- Review account history

- Non-receipt of credit card/debit card to their address

.

In short, chatbots have solved the challenges of traditional banking problems. Examples – going to banks and standing in queues to get their questions answered by bank staff.

The other benefits are:

- They can handle many queries at the same time

- Can give satisfactory answers to common/routine questions

- Clarify doubts about products and services

- They can work 24/7/365 all around the year.

.

.

How Chatbots Help in Improving Customer Experience

- The chatbot will give the relevant answer for a query in the fastest possible way during peak times.

- Chatbots can deactivate credit cards & debit cards. They can take online requests from a customer to reduce fraudulent transactions.

- They can give valuable information about new banking products/services. This helps the customers to make good financial decisions.

- Chatbots can complete routine support tasks such as onboarding for new customers. They can also resolve simple queries such as fund transfers.

.

.

Technical Features a Banking Chatbot Should Have

1. Conversational

Customers rarely converse with customer care service centres today. The reason is that it is possible to get solutions for any technical problem via the mobile app chat. So, the customer makes a call, only for technical challenges. These, he/she would not have been able to solve by the app or website. So, he/she should feel that they are conversing with a human.

The answers should give a personalised touch. In short, it should not be generic. For example, the question is about the last date of withdrawal. The chatbot should promptly convey the message – “Kindly note <name of the client>, that the last withdrawal of USD 100 happened on 28 January 2025.”

Recorded conversations can leave customers frustrated. So, a chatbot should converse/chat as a human does with proper grammar, syntax, pause and other details.

.

2. Valuable Information

The software design and information should be up-to-date. Banks should understand a product, software or service, is an extension of their brand. So, the chatbot may have to share information such as fees for fund transfers, due dates and policies. Let us assume, there is a mismatch. It would result in customers getting confused and causing harm to the bank’s brand image.

.

3. Transactional

The purpose of a banking chatbot should be to reduce the routine work done by human agents and cost savings. The finance team should keep a proper check on the following details:

- Has the chatbot contributed to reducing interaction with the customer service executive?

- Has the chatbot saved a considerable amount of money? The technical team can compare the costs of customer care executives and equipment. The finance team needs to keep a tight check on the costs associated with the workforce.

.

4. Security Features

The chatbot should contain features that ensure the safety of customer’s information. Banking websites/chatbots and apps remain the prime targets of cyberattacks. So, encryption protocols are necessary to prevent fraudulent activity.

.

5. Information from All Departments

A bank may have designed many chatbots. The designer needs to know the departments the bot interacts with to give the best solutions. The application programming interface should be tested at various levels. The chatbot should get accurate information from all sectors to answer queries. The bank software should comply and act in tandem with the chatbot.

6. Gather Data

The chatbot can get valuable information from every interaction. It can get valuable information about products, services, pain points and user preferences. An analytical component chatbot can gather vital information about customer preferences. The bank management can then view the report and make necessary changes (if needed).

For example, if a customer has travelled to another country. He/she makes a purchase. Then the chatbot can send an alert notification asking “Have you purchased in Los Angeles?.” The chatbot would have detected unusual spending activity. The chatbot will give other options so that the customer can either confirm or deny the alert notice. Let us assume a fraudulent activity detected in a customer’s banking account. The technical team should design the chatbot with instructions for deactivating the card.

.

7. Taking Product Reviews and Getting Customer Feedback

Customer testimonials and reviews are mandatory for creating a brand. The bank chatbots can collect feedback/reviews from customers via survey forms. This will help to know about customer likes, dislikes and modifications they desire in a product or service.

.

.

Summary

There can be a sudden hike in customer queries when the bank introduces a new product/service. The technical team has to ensure that the chatbot contains the right information to understand & then reply to queries.

Customers of reputed banks sometimes face impersonal and irresponsible customer care service. Chatbots can save that option by offering end-to-end solutions in an empathetic tone. Also, it removes the traditional methods of customer support, assists the customer by providing the best solutions and helps banks/financial institutions retain customers.

.

Blog by SathyaNarayana B.